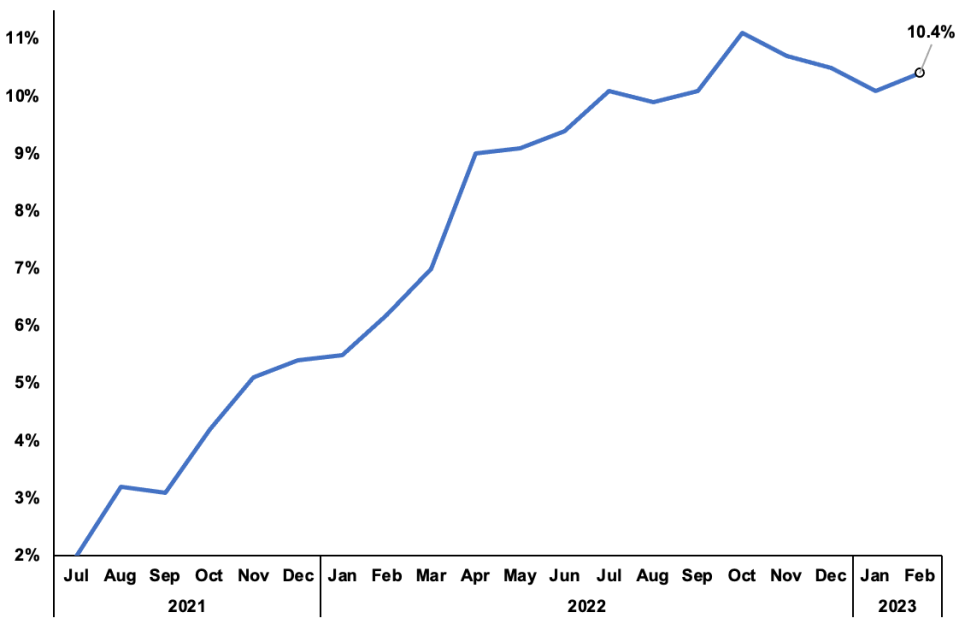

UK inflation is poised to slip out of the double digits for the first time since last summer in what could be the beginning of the cost of living crisis gradually releasing its grip on families over the rest of the year.

Official figures from the Office for National Statistics (ONS) on Wednesday are expected to show inflation trimmed to 9.8 per cent in March, down from 10.4 per cent.

But there are likely to be strong price pressures hidden within the numbers, with the rate of core inflation poised to stay elevated.

Core inflation – expected to fall slightly to six per cent – has become market participants’ key gauge of how much inflation is persisting in response to the Bank of England’s eleven successive interest rate rises to a post-financial crisis high of 4.25 per cent.

Bank Governor Andrew Bailey and his team of rate setters have signalled the core services inflation, which analysts don’t think is on course to have fallen materially last month.

Inflation has raged for more than a year

“We don’t anticipate a big easing in core services inflation,” Paul Dales, chief UK economist at consultancy Capital Economics, said.

Meanwhile Sanjay Raja, senior economist at investment bank Deutsche Bank reckons “some negative payback from February’s higher catering prices, which were likely due to Valentine’s Day effects” will bring inflation lower.

“Clothing too was abnormally strong, and should slow in March. A drop in pump prices will also help drag inflation lower,” he added.

Elsewhere, jobs figures from the ONS on Tuesday are tipped to show unemployment held steady in February at 3.7 per cent, a multi decade low.

That could raise expectations for another rate rise from the Bank on 11 May. Officials at the central bank are concerned that strong wage growth amid a tight labour market could keep inflation above its two per cent target over the long term.

Fresh purchasing managers’ indexes (PMI) out on Friday, which are closely watched by the City, could show British factories are performing a bit better despite a big rise in costs.

“Driving a bump up should be some improvement in output, employment and new orders,” pushing the manufacturing PMI up to 48.5, still below the 50 point growth threshold, Raja added.

Consumer confidence numbers from research firm GfK, out on Friday, are also likely to show households are a bit more optimistic about the UK economy.

On the corporate front, online fashion retailer THG posts final results on Tuesday, while US banks’ earnings season draws to a close.

Last week, London’s FTSE 100 notched a health 2.73 per cent gain to close at 7,871.90 points.

Source : CityAM